Before buying life insurance, ask yourself some vital questions. Why is this insurance necessary for you? How much coverage do you need to protect your loved ones? What type of policy, term or permanent, aligns best with your goals? Consider the duration of coverage and how premium payments will affect your budget. Don't forget to inquire about additional benefits like riders and any possible exclusions. Finally, understand the claims process and what to expect from your insurer. These insights will help clarify your path forward, revealing more essential details that can guide your decision.

Key Takeaways

- What is the appropriate coverage amount based on my financial obligations and future needs?

- What type of policy (term or permanent) best aligns with my financial goals and circumstances?

- Are there flexible premium payment options available to accommodate my financial situation?

- What riders or additional benefits can be added to enhance my policy's coverage?

- What are the policy exclusions that I should be aware of to avoid claim denial?

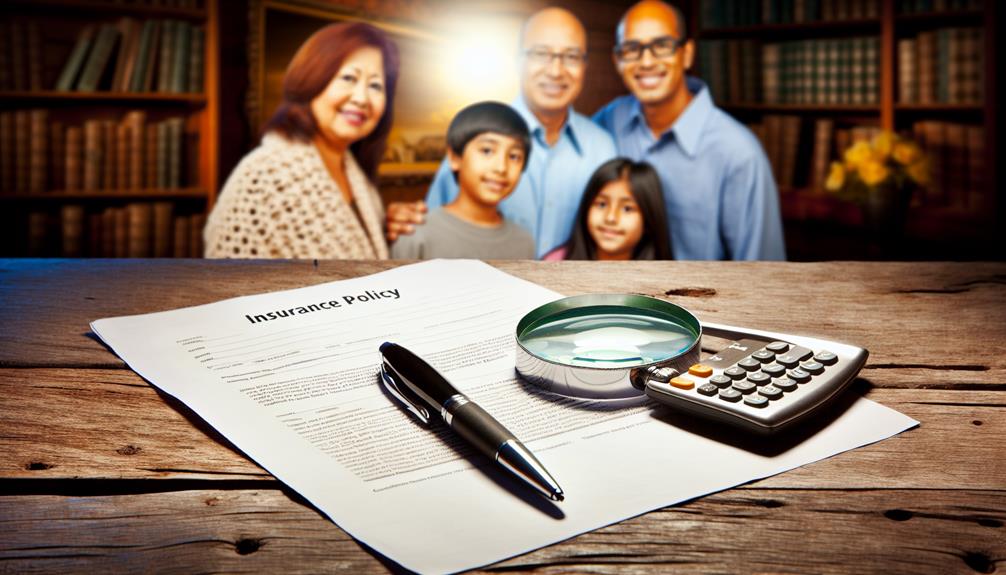

Why Is Life Insurance Necessary?

Life insurance is essential not just for you, but also for your loved ones. It provides the financial security your family needs in the unfortunate event of your untimely death. With a death benefit, life insurance replaces lost income, guaranteeing your dependents can maintain their standard of living. This coverage can alleviate the financial burden of significant expenses, like funeral costs, which can average between $7,000 and $12,000.

Moreover, life insurance can help pay off outstanding debts, including mortgages and loans. This way, your loved ones aren't left grappling with financial obligations that could create stress during an already difficult time. By securing this type of coverage, you also have the opportunity to leave a legacy or inheritance for your children or grandchildren, contributing to their future financial stability.

Additionally, if you have charitable intentions, life insurance allows you to provide funds for donations to organizations that matter to you. In this way, you guarantee your personal values live on after you're gone. Ultimately, investing in life insurance is a proactive step to safeguard your family's financial future and uphold your legacy.

How Much Coverage Do I Need?

Figuring out how much life insurance coverage you need starts with evaluating your financial obligations and future expenses. Think about factors like your dependents' needs and any outstanding debts. Using online calculators can help you estimate the right coverage amount tailored to your specific situation.

Assess Financial Obligations

Determining how much life insurance coverage you need is essential for safeguarding your loved ones' financial future. Start by evaluating your immediate financial obligations, like any outstanding debts, mortgages, or loans. If something happens to you, your dependents shouldn't have to worry about these financial burdens.

A common rule of thumb suggests a policy amount of 10 to 15 times your annual income to guarantee adequate protection for your family. This figure helps cover essential expenses that your dependents would face if you're no longer there to provide for them.

Utilizing online life insurance calculators can simplify this process, allowing you to input your specific financial circumstances and obligations to estimate necessary coverage.

Consider Future Expenses

When planning for the future, it's crucial to account for the expenses your loved ones will face if you're no longer there to provide for them. One way to determine how much coverage you need is to aim for a policy that's 10-15 times your annual income. This guideline helps guarantee you have enough to replace lost income and cover future expenses, like children's education and mortgage payments.

Don't forget immediate obligations, such as funeral costs and outstanding debts, which can add up to $15,000 to $30,000. Think about future expenses like the average cost of a four-year public college, which can exceed $100,000. You'll also want to evaluate ongoing income needs for your dependents, so your coverage can replace lost income for several years, depending on how long you wish to support them.

As you consider these factors, set clear financial goals to guide your decisions. Purchasing life insurance is an important step in safeguarding your family's future, and understanding their potential needs will help you choose the right coverage for a specified amount.

Use Coverage Calculators

Using coverage calculators can be a smart way to assess how much life insurance you truly need. These tools typically suggest an amount of 10-15 times your annual income to guarantee adequate financial protection for your dependents. When you use a coverage calculator, make sure to factor in all your financial needs, including future expenses like children's education, mortgage payments, and outstanding debts.

Many calculators also take into account non-monetary contributions, such as childcare and household services, which can greatly influence the suggested coverage amount. By entering specific details about your lifestyle, health, and family needs, you can obtain a more tailored recommendation.

It's vital to regularly update your coverage needs with a calculator, especially after major life changes like marriage or having children. This practice helps you maintain the appropriate level of financial security. As you navigate this process, remember to reflect on the questions to ask regarding your policy options and coverage amounts. By utilizing coverage calculators effectively, you'll be better equipped to make informed decisions about the life insurance you need.

What Type of Policy Should I Choose?

When choosing a life insurance policy, you need to contemplate whether you want temporary coverage with term life or long-term protection with whole life. Think about your financial goals and whether you prefer a policy that builds cash value. Also, evaluate your budget to find a plan that fits your needs without stretching your finances.

Term Vs. Permanent Insurance

Choosing between term and permanent insurance can greatly impact your financial planning. Term life insurance offers coverage for a specified duration, typically 10 to 30 years, and is generally more affordable. This makes it suitable for short-term financial needs, like income replacement and debt coverage. However, keep in mind that if you outlive the term, the policy expires without a payout.

On the other hand, permanent life insurance, which includes whole and universal life, provides lifelong coverage. It features a cash value component that accumulates over time, blending insurance protection with a potential investment aspect. Permanent policies guarantee a death benefit as long as you pay the premiums, making them ideal for long-term wealth accumulation and legacy planning.

When deciding, consider your financial goals. If you're looking for temporary, affordable insurance coverage, term life might be the way to go. But if you value lifelong protection and the added benefit of cash value, permanent life insurance could be more suitable. Additionally, universal life insurance offers flexibility with adjustable premiums and death benefits, adapting to your changing financial situation while still securing permanent coverage.

Coverage Needs Assessment

After understanding the differences between term and permanent insurance, it's important to evaluate your specific coverage needs. A thorough coverage needs assessment guarantees you choose the right policy for your situation. Start by assessing your financial obligations, including debts, mortgage, and future expenses like your children's education. This helps you determine the appropriate coverage amount.

Here are three key points to reflect on:

- Temporary vs. Permanent: Decide if you need a term life insurance policy for temporary coverage or a permanent life insurance policy that offers cash value accumulation for long-term goals.

- Coverage Amount: Use the rule of thumb to aim for a coverage amount of 10-15 times your annual income. This guarantees adequate protection for your dependents.

- Life Changes: Regularly review your needs, especially after significant life events like marriage, a new child, or income changes.

Also, reflect on your age, health status, and lifestyle choices, as these factors can influence the type of policy you should choose and premium costs. By addressing these elements, you can guarantee your coverage aligns with your evolving financial situation.

What Is the Duration of Coverage?

Understanding the duration of coverage is essential when selecting a life insurance policy, as it directly impacts your financial security. The duration of coverage can vary greatly among different types of policies. For instance, term life insurance typically offers coverage for a specific period, usually ranging from 10 to 30 years. This option may suit you if you need protection for a defined time, like until your children are financially independent.

On the other hand, a whole life insurance policy provides coverage for your entire lifetime, as long as you continue to pay the premiums. If you're looking for lifelong security, this might be the right choice for you. Universal life insurance offers even more flexibility, allowing you to adjust both your premiums and death benefits over time.

When evaluating your options, consider your life expectancy and any future financial needs. Life events such as marriage, having children, or changing jobs can greatly impact your coverage needs. Regularly reviewing your policy guarantees it aligns with your evolving circumstances, helping you maintain the right duration of coverage for your life insurance needs.

How Will Premium Payments Work?

Steering premium payments is essential when selecting a life insurance policy, as they can vary widely based on your age, health, and lifestyle. Understanding how premium payments work can help you make informed decisions. Here are three key points to evaluate:

- Payment Frequency: Insurance providers often offer various payment schedules. You can choose to pay premiums monthly, quarterly, annually, or even as a one-time lump sum. Select what best fits your financial situation.

- Type of Policy: Term policies typically have lower premium payments compared to permanent policies. Be aware that some term policies may have increasing rates over time, especially if they are annually renewable.

- Flexible Premium Options: Certain policies allow for flexible premium payments. This means you can adjust your payments based on your cash flow and changing financial circumstances, providing you with added convenience and control.

Is Flexibility in Payments Available?

When considering life insurance, it's crucial to check if flexibility in premium payments is available. Many policies require consistent premium payments, but some offer flexible payment options that can suit your financial needs. If you're a business owner or have an irregular income, look for policies that allow larger upfront payments or flexible payment schedules.

Universal life insurance, for example, provides you with the ability to adjust your premium payments based on your current financial situation. This payment flexibility can be a game-changer, helping you maintain coverage even when your finances fluctuate.

Additionally, some insurers offer paid-up policies, which require no further premium payments after a specific point while still keeping your coverage intact. It's important to inquire about the specific terms and conditions surrounding these flexible options. Understanding how payment flexibility works will guarantee you choose a policy that aligns with your long-term financial goals. So, don't hesitate to ask your insurance agent about the various flexible payment options available to you before making a decision.

Are Additional Benefits or Riders Offered?

What additional benefits or riders can enhance your life insurance policy? Riders can markedly increase the value of your coverage and tailor it to your needs. Before finalizing your decision, consider the following riders that might be available:

- Accelerated Death Benefit Rider: This allows you to access a portion of your death benefit if you're diagnosed with a terminal illness, providing financial support when you need it most.

- Waiver of Premium Rider: If you become disabled and can't work, this rider lets you skip premium payments, ensuring your coverage continues without financial strain.

- Child Term Rider: You can add this rider to provide life insurance for your children at lower rates than individual policies, securing their financial future.

It's essential to understand the terms and costs associated with these riders, as they can affect your overall premium and the payout structure of your policy. By exploring these options, you can enhance your life insurance coverage to better meet your family's needs in the future.

What Are the Policy Exclusions?

Before you buy a life insurance policy, it's important to understand the common exclusions that could affect your coverage. Many policies may not pay out if death occurs due to suicide within the first two years or from illegal activities. Knowing these exclusions can help you navigate the claims process and avoid any unwelcome surprises later on.

Common Exclusion Scenarios

Understanding your life insurance policy's exclusions is crucial for ensuring financial protection for your loved ones. Common exclusions can greatly impact your coverage, so it's important to be aware of them before making a decision. Here are three common scenarios to reflect upon:

- Death by Suicide: Many policies exclude suicide claims, especially within the first two years. This means if you pass away due to suicide during that time, your beneficiaries may not receive any benefits.

- Pre-existing Health Conditions: If you have existing health issues and fail to disclose them during the application process, your policy may not cover related claims. Insurers often require full transparency to assess risk accurately.

- High-Risk Activities: Engaging in extreme sports, aviation, or other high-risk activities can lead to exclusions in your policy. If you die while participating in these activities, your claim might be denied.

Additionally, non-disclosure of material facts, like smoking or hazardous jobs, can void your policy altogether. Understanding these common exclusions will help you make informed choices for the future.

Impact on Claims Process

The exclusions outlined in your life insurance policy can greatly impact the claims process when your beneficiaries need to file for benefits. Many policies include exclusions for death by suicide within the first two years of coverage, meaning claims during that period might be denied. It's also crucial to understand that if your death results from illegal activities or acts of war, your beneficiaries may face denied claims as well.

Certain health conditions, particularly those not disclosed during the underwriting process, could lead to exclusions from coverage or claim denial. If you fail to disclose material facts, such as pre-existing medical conditions or risky lifestyle choices, you risk voiding your policy altogether. This emphasizes the significance of being honest and thorough during the underwriting stage.

To avoid surprises later, read your policy documents carefully. Look for specific clauses that may limit payouts and clarify what is and isn't covered. By understanding these exclusions, you can better navigate the claims process and guarantee your beneficiaries receive the benefits they deserve when the time comes.

How Does the Claims Process Work?

When a loved one passes away, initiating the claims process for life insurance can feel overwhelming, but knowing the steps can help ease the burden. As a beneficiary, your first move is to file a claim with the insurance company. Here's what you need to do:

- Gather Documentation: You'll need to provide the death certificate and the policy number. This information is essential for the insurer to process your claim.

- Communicate Promptly: Timely communication with the insurer can greatly expedite the claims process. They'll likely need details about the deceased's health history and circumstances around the death, especially if it falls within the contestability period.

- Understand Exclusions: Before you submit your claim, familiarize yourself with the policy's exclusions and limitations. This knowledge can prevent surprises if your claim is denied.

Be prepared for the claims process to take several weeks, as insurers often conduct investigations to verify the claim's validity. If your claim is denied, you can appeal the decision, but knowing the exclusions ahead of time will help you avoid unnecessary disappointment.

What Should I Know About the Insurer?

Choosing the right insurer is essential for securing your life insurance policy. Start by researching the insurance company's financial strength. Check ratings from agencies like A.M. Best, Moody's, or Standard & Poor's to confirm they can fulfill their obligations. A strong financial rating is important for your peace of mind.

Next, explore the insurer's claims handling history and customer service reputation. Look for customer reviews and complaint ratios to gauge overall satisfaction among policyholders. This will help you understand how the company treats its clients during critical times.

Consider the length of time the insurer has been in business. Established companies often have more experience managing policies and claims, which can be a significant advantage.

Don't forget to evaluate their product offerings. Different insurers provide various types of life insurance and unique features or riders that may suit your specific needs. Finally, verify the insurer's compliance with state regulations and licensing. Ensuring they're authorized to operate in your state is essential for your protection. With these factors in mind, you'll be better equipped to choose the right insurer for your life insurance policy.

Frequently Asked Questions

What Should You Consider Before Buying Life Insurance?

Before buying life insurance, you should consider your financial obligations, like debts and future expenses, to determine how much coverage you need. Take a look at different policy types, such as term or whole life, to see what fits your goals and budget. Research insurers' financial stability through ratings and understand any policy exclusions that might affect your beneficiaries. Finally, think about adding riders for extra protection and flexibility in your coverage.

What Not to Say When Applying for Life Insurance?

When applying for life insurance, don't say you've never smoked if you've recently quit. For instance, if you downplay your smoking history, the insurer may find out later and deny your claim. Always be honest about your health and lifestyle. Avoid exaggerating or omitting details about pre-existing conditions, past insurance claims, or risky hobbies. Clear, accurate answers guarantee you get the right coverage without unexpected issues down the line.

Which Three Questions Are Likely to Be Asked by Life Insurance Companies to Determine the Price of a Policy?

When applying for life insurance, you'll likely face questions about your age, health history, and lifestyle choices. They'll ask your age to calculate risk, as premiums rise with age. Expect inquiries about pre-existing conditions and medications, as these impact your health assessment. Finally, they'll want to know about your smoking status and exercise habits, since these lifestyle factors can greatly influence your policy's cost. Be prepared to answer honestly!

Which Question Is Likely to Be Asked by a Life Insurance?

Imagine sitting in a quiet room, the weight of your future hanging in the air. One question's bound to come up: "What's your medical history?" This simple inquiry can reveal a lot about your life and risk factors. Insurers want to know if you've got any pre-existing conditions or past health issues. Your answers could shape your premiums, so be ready to share honestly and clearly about your health journey.

Conclusion

Buying life insurance can feel overwhelming, but asking the right questions can simplify the process. You might think all policies are the same, but they vary greatly in coverage, costs, and benefits. By digging deeper into your needs and the insurer's offerings, you can uncover the best fit for you. Remember, life insurance is more than just a safety net; it's peace of mind for you and your loved ones. Don't leave your future to chance!